James Ye2024-05-10 01:45:55

1 Introduction

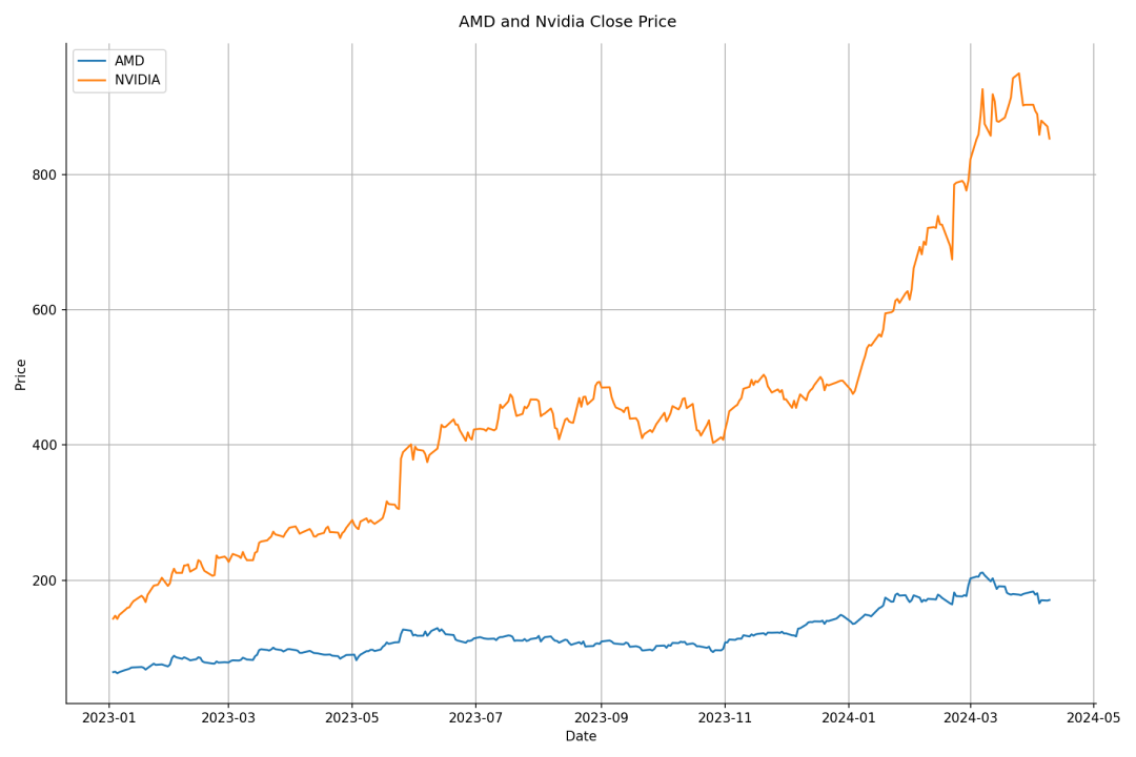

Figure 1: AMD and Nvidia Stock Prices

Source: Yahoo Finance as of 04/10/2024

In the financial industry, AI has become more reliable and helpful for people involved in quantitative research, trading, decision-making, and portfolio/risk management. This report explores the impacts of AI on traditional finance and cryptocurrencies, including trading processes, price and trend prediction, trading strategies, and financial market security. The goal of this report is to understand the potential impacts of AI on the financial market. It is important to consider whether AI will lead to a new level of development for humans in this field.

2 Applications of AI in the Financial Market

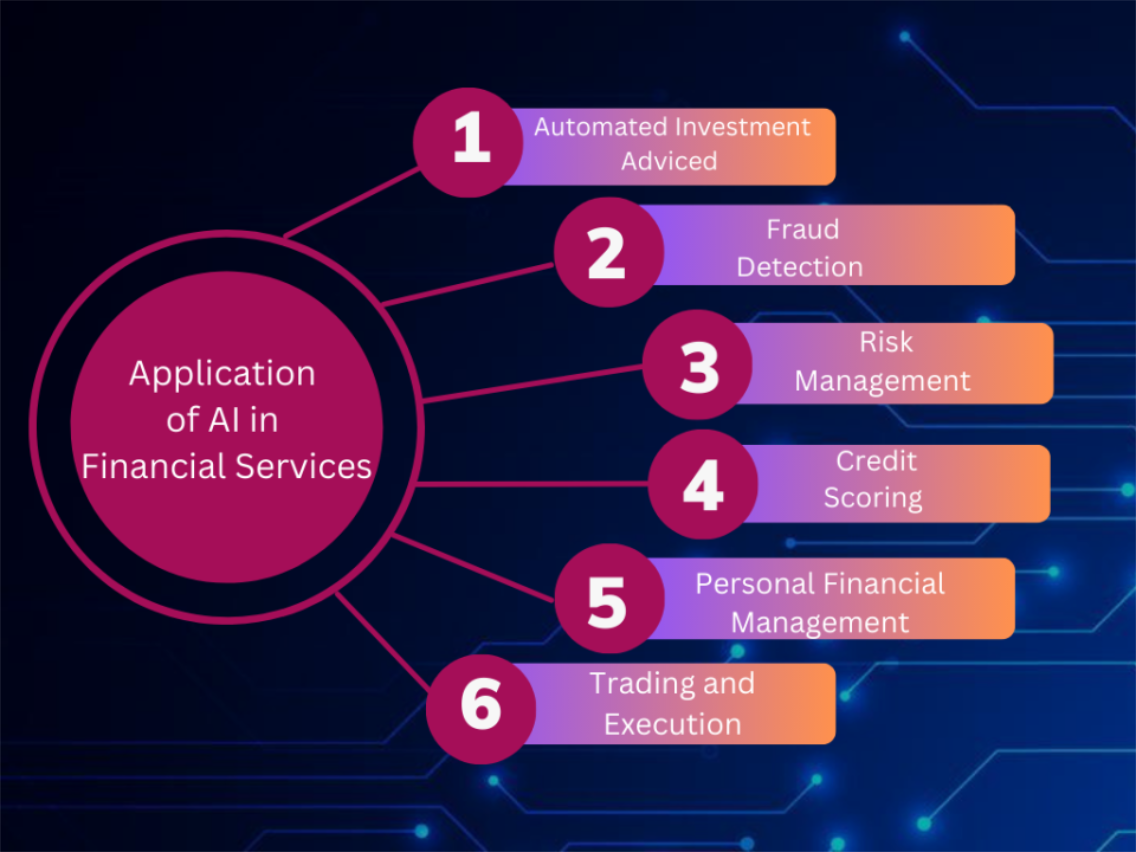

Artificial intelligence offers a new approach to trading, monitoring, and security. AI can be applied to various areas in finance, including but not limited to risk/portfolio management, sentiment analysis, price prediction, anomaly detection, etc. AI can reduce work pressure and minimize the risk of human error. It is important to note that AI is not a cure-all and should be used in conjunction with human expertise. The below examples illustrate how AI collaborated with humans in finance.

Figure 2: Applications of AI in Finance

Source: Gemini - Google

2.1 Portfolio Management

Portfolio management is the art and science of selecting and overseeing a group of investments that meet the long-term financial objectives and risk tolerance of a client, a company, or an institution[1]. Artificial intelligence in portfolio management primarily involves fundamental analysis, portfolio optimization, and risk management. Fundamental analysis is used to evaluate the intrinsic value of a security. The process of fundamental analysis involves the examination of a range of factors that could potentially influence the intrinsic value of an asset. These factors encompass microeconomic and macroeconomic conditions, industry trends, company financials, and management qualities, among others. The goal of fundamental analysis is to ascertain whether an asset is overvalued, undervalued, or fairly valued based on its fundamental characteristics.

In the context of AI, the portfolio manager will have greater access to real-time information than they would through traditional means, such as searching websites, papers, and news. For instance, real-time chatbots like Google’s Gemini or OpenAI ChatGPT 4.0(with plugins), can retrieve data from online directly. Then, perform sentiment analysis in the current market.

Optimization is to optimize the allocation between the various assets comprising the portfolio in a manner that minimizes risk for a given expected return[2]. AI algorithms can facilitate the construction and optimization of portfolios by recommending asset allocations based on risk tolerance, investment objectives, and market conditions. These algorithms can continuously monitor the portfolio and adjust as needed to maximize returns and minimize risk. Optimization and risk management are complementary in fundamental analysis.

2.2 Sentiment Analysis

Sentiment analysis is an application of natural language processing(NLP) that trains computer software to understand text in ways similar to humans[3]. Sentiment analysis employs social media data, including news, articles, and comments, and then labels them with the sentiment words(positive, negative, neutral). In particular, sentiment analysis can provide valuable insights for those who invest in or are interested in investing in highly volatile products, such as cryptocurrency.

The direct application of text data to the AI model eliminates the need for time-consuming training and visualization processes. Manual coding, on the other hand, necessitates a high degree of expertise and ongoing fine-tuning, rendering it challenging to maintain adaptability to diverse text types. In contrast, AI is adept at processing vast quantities of data and automatically visualizing the percentage of sentiment words. When a researcher is confronted with a plethora of disparate sources, including news, articles, and journals, the application of AI can significantly streamline the process of importing and analyzing this information. Moreover, AI's capacity to learn from complex patterns and nuances in language, which may be challenging to capture with manually crafted rules, could lead to higher levels of accuracy.

The construction of a sentiment analysis system from the ground up necessitates a substantial investment of time and resources in the design of algorithms, the management of edge cases, and fine-tuning of parameters. In contrast, the implementation of AI models can be accomplished in a relatively expeditious manner by leveraging existing libraries and pre-trained models. AI will continue to evolve in response to new data and feedback, with the advancement of AI occurring at a faster pace than ever before.

2.3 Predictive Analysis

Machine learning algorithms can be trained to identify the patterns and relationships between historical data and market conditions to predict future performance. Normally we use linear regression to identify the relationship between stock prices on different days. Like sentiment analysis, prediction usually handles big data, AI can efficiently process and analyze large volumes of data, including structured and unstructured data, from diverse sources.

At this point, AI models can make predictions based on real-time data, thereby enabling organizations to receive more timely information to adjust their strategies and decisions regarding future investments. This can be advantageous for medium trades. However, those involving cryptocurrency predictions are currently unable to make relatively smooth predictions.

2.4 Anomaly Detection

Anomaly detection is the process of identifying unusual or atypical patterns in financial data that deviate from normal behavior. This process plays a crucial role in detecting potential risks, frauds, or inefficiencies in financial systems. In this context, AI is employed to identify fraudulent transactions and prevent insider trading. It also detects anomalies promptly to stop losses, which is known as risk management. Anomaly detection is the use of AI in the security aspects of transactions, all controlled by the AI model, to reduce human errors in the process of operation.

3 Major Impacts on the Financial Market

This section will discuss the impacts of AI on the financial market. The impacts are multifaceted, and this section will focus on a few aspects that we believe are currently having a greater impact. There are three major areas we believe have positive impacts: efficiency, automation, and accuracy. On the other hand, we believe data quality and bias, security and privacy, regularization, and lack of interpretation might harm the market.

3.1 Efficiency

AI algorithms can analyze large volumes of financial data much faster than humans, leading to faster decision-making processes and improved efficiency in trading, risk management, and other financial operations. In quantitative finance, researchers or traders usually deal with 1 million pieces of data at least to identify quantitative factors like momentum, volatility, P/E ratio, and others. In the majority of cases, it is sufficient to preprocess the data, such as by padding missing values, normalization and regularization of the data, and then feeding it directly into the AI model. This eliminates the need for code editing to a certain extent.

3.2 Automation process

The recent focus on automation has led to an increased interest in its potential to reduce costs and improve efficiency. In finance, automation is primarily observed in quantitative trading, risk management, fraud detection, and customer service. By reducing the probability of human error in the trading process, automation speeds up the process, reducing the need for human resources. Customer service, in particular, might be a little bit different than other tasks. Generally speaking, the AI receives the data and then pre-runs the model. Based on the model feedback, it communicates and provides the answers to the questions posed by the user.

3.3 Accuracy of AI

AI models can leverage advanced machine learning and statistical techniques to make more accurate predictions and identify patterns in financial data that may not be apparent to human analysts. The accuracy of model predictions can be a factor in decision-making. Investors can determine their investment amounts and strategies based on the predictive data from existing models. In contrast to traditional quantitative finance, the use of AI reduces the requirement for statistical mathematics and does not require much time for modeling.

3.4 Data quality and bias

Despite the efficiency gains that artificial intelligence has brought to the financial industry, some problems cannot be avoided in its use. Firstly, the quality and bias of data are mixed. The training of AI requires heavy data, and poor data quality or biased datasets could lead to inaccurate predictions or reinforce existing biases. Financial data may contain errors, inconsistencies, or missing values, which can affect the performance of AI models. ChatGPT, for instance, presents data according to the user's specifications. Therefore, if users provided with inadequate data, AI may generate responses that deviate from the actual conditions.

3.5 Data privacy and security

We posit that the most significant negative impact is on data security and privacy. As previously stated, AI necessitates a vast quantity of data for training purposes. However, certain financial data is highly confidential and therefore not permitted to be open source. Consequently, the majority of research departments in investment banks will not permit the input of any open-source AI, even if the AI company provides specific solutions for them. Furthermore, AI systems in finance may be susceptible to cyberattacks, data breaches, or manipulation, which could pose security and privacy risks for financial institutions and their customers. Consequently, an increasing number of companies are prohibited from utilizing ChatGPT, Gemini, and other forms of open-source AI within their organizations, with a preference for the deployment of their own AI models with specific data sets. Unfortunately, this new deployment will necessitate additional expenditure in terms of engineering resources and devices, but it will ensure the security and privacy of data.

3.6 Regularization and Interpretability

Any technology that develops at a rapid pace initially lacks a certain amount of regulations. This is also true in AI. Currently, there is no unified regulatory model for AI, which may lead to the occurrence of criminal activities such as face recognition, voice description, and the generation of AI-generated content. The use of AI in the financial market raises regulatory and ethical concerns, particularly regarding transparency, accountability, and fairness. Regulators may struggle to keep pace with technological advancements, leading to uncertainty and potential regulatory challenges. Another aspect is the interpretability of AI. Most AI models, especially deep learning models, lack interpretability, making it difficult to understand how they arrive at their predictions. This lack of transparency can undermine trust in AI systems and hinder regulatory compliance efforts.

4 Discussion

The present report merely points out some of the possible effects on the financial industry. We believed that these effects will continue for some time to come. This study does not delve into the impact on human resources. However, We think that under the rapid development of the current situation, artificial intelligence will gradually replace some low-end operations, such as documenting. In data processing, it seems probable that there will be a reduction in the number of human resources required for data analysts in the future, given that AI is now able to perform exploratory data analysis(EDA) for data visualization and feature extraction. In terms of data security, decentralized finance (DeFi) will likely slow down the existing situation, through decentralized data training and open access to idle GPUs, to achieve the rational use of resources and maximize the reduction of the burden of investment in enterprises and individuals.

5 Conclusion

The integration of AI into traditional finance will result in a significant transformation. The cryptocurrency market is currently experiencing a convergence with AI, which plays a pivotal role in transaction security. Concerning the relationship between AI and traditional finance, it can be posited that AI and finance are inextricably linked, and it is uncertain whether the impact of AI will be beneficial or detrimental. AI will continue to exert an ever-increasing influence on the human resources employed in the financial market. AI will replace the majority of data analysts and financial analysts, and the operating costs of small and medium-sized enterprises will be reduced by at least one-third in the future.

References

1.Investopedia: Adam Hayes; Portfolio Management: Definition, Types, and Strategies, February 16, 2024

2.Rothschild & Co: Xavier de Laforcade; The impact of Artificial Intelligence on portfolio management, September 08, 2023;

3.AWS: What is Sentiment Analysis?